ESG ratings have become the talk of the boardroom. With growing concerns around sustainability, they are quickly gaining ground as a key metric used in decision making both by issuers and by investors. This was recently highlighted in an HBR research study of the leaders of the 43 global institutional investing firms, including the top 3 asset management firms in the world:

“We found that ESG was almost universally top of mind for these executives.”

From the effect of environmental and social matters on the sustainability of the business long-term to culture changes to nurture a more inclusive workplace, knowing a company’s ESG rating is vital for helping issuers steer the business in the right direction, attracting investment and improving shareholder transparency.

What is an ESG Rating?

A host of third party agencies provide reports on the environmental, social and governance (ESG) performance of businesses over time. They score them with what is known as an ESG rating. The different agencies use varied methodologies to compile their ratings.

Yet, investors use ESG rankings to compare businesses using the criteria that matter most to them. Analysing data from the same ESG agency over many years allows them to track the trajectory of the company in all areas relating to the environment, social issues and governance.

The matter may seem a bit more complex when you consider the diverse scales used by the agencies. Some ratings display as a number between 1 and 100. Others use letters, such as AAA to CCC or D, and some rank the ESG performance of businesses in deciles.

What Does it Measure?

In the broadest terms, your ESG rating measures the long-term sustainability and the future societal and environmental impact of your business. It is calculated by taking into account a range of different factors. Each ratings agency bases its reports on a different selection of indicators. Here are some of the factors that can affect ESG ratings.

Environmental

- CO2 emissions

- Waste disposal

- Renewable energy use

- etc.

Social

- Community relations

- Political contributions

- Diversity in the workplace policies

- etc.

Governance

- Executive compensation

- Financial results and management

- Gender diversity

- etc.

Some agencies measure this data on an annual basis, others update their rating daily. Companies may even face “penalties” from the agencies if any required data is missing. So, to protect the business image, it may be a good idea to be open and compliant with these external assessors.

How Are ESG Ratings Used?

There are two main ways to use ESG ratings. Firstly, they help inform internal strategy and investment decision-making. But, they are also key in helping organisations make investment decisions.

A recent survey of sustainability professionals by SustainAbility found that nearly two-thirds of respondents confirmed they took their ESG ratings into account when making business decisions. This is even higher when looking solely at the corporate world, where 72 percent of respondents reported that they found ratings useful for decision-making.

According to the report, ratings proved useful with “internal assessments and strategy, to help inform what data to disclose, identify trends and support stakeholder engagement.”

Responders told the survey that they track their company’s ESG score across many agencies to identify trends that can inform their strategy. Others confirmed that they used the scores to prioritise action plans, and some mentioned the ratings’ usefulness in comparing their performance against their competitors.

For investors, the ESG rating of a business is a key indicator of the potential risk and return from allocating capital to that company, giving them a clearer view of its potential future financial performance. Investors are evermore interested in sustainable initiatives and are aware of the impact that environmental, social and governance issues can have over profitability. Therefore, a company with a good ESG score can often seem like a more attractive proposition for responsible investment opportunities.

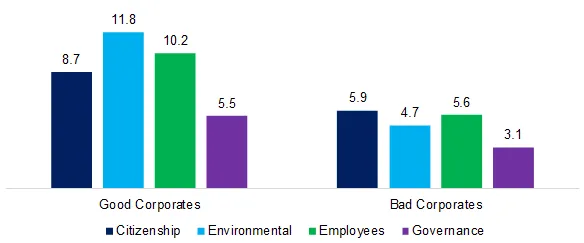

(Average Market Capitalizations (US Billions), 2009–2018. Source: Factor Research)

(Average Market Capitalizations (US Billions), 2009–2018. Source: Factor Research)

Other uses of the ratings include the level of insurance premiums charged to a business. Also, the interest rate on loans to that business and informing whether suppliers bid for tenders.

ESG Rating Methodology

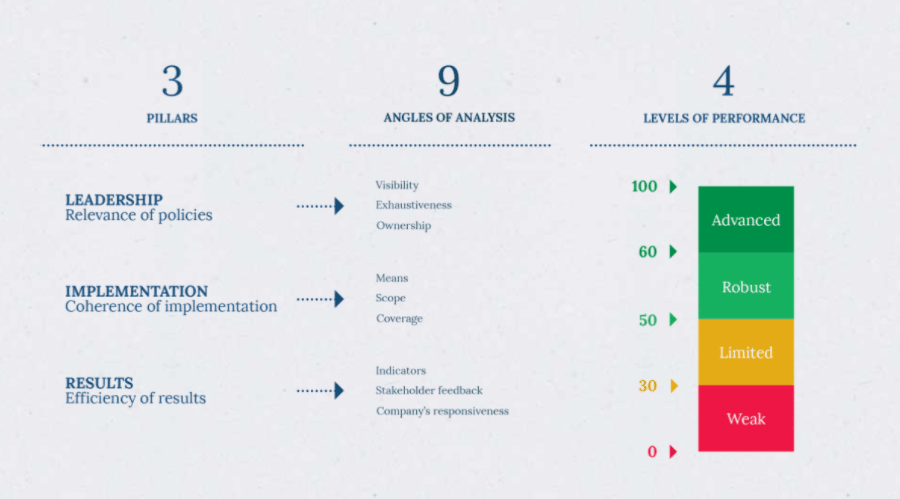

There is no single ESG rating methodology, which is why there may be a difference between ratings from separate agencies. As an example, you can consider the methodology used by V.E, formerly Vigeo Eiris, who partnered with Euronext in designing the Euronext Large 80 Index.

This methodology analyses a number of environmental, social and governance responsibility factors. The resulting score reflects an organisation’s commitments, ability to manage risks and managerial efficiency, along with their sustainability performance.

ESG Ratings Agencies

Here is more information about the ESG ratings agencies you’re most likely to encounter, featuring details on how they generate their scores for businesses across different sectors.

Please note that this list isn’t exhaustive. It could go on and on because there is a growing number of providers out there. Besides, choosing one should be guided by your specific needs. That being said, we hope this list gives you an idea about the different approaches and rating scales that you can come across in your search.

|

Agency |

Rating Scale |

Methodology |

|

MSCI ESG Research |

AAA to CCC. |

Based on information from government, NGO and academic databases, and company disclosures. Separates environment, social and governance into three pillars, with ten themes – natural resources, pollution & waste, climate change, environmental opportunities, product liability, stakeholder opposition, human capital, social opportunities, corporate governance, and corporate behaviour. |

|

Sustainalytics Company ESG Reports |

Out of 100, compared against industry. |

Covers a minimum of 70 indicators, weighted depending on the industry. Split into three areas – preparedness, disclosure and performance. |

|

V.E (Vigeo Eiris) |

Out of 100, compared against others in the same sector. |

Using a framework of 38 precise sustainability criteria based on UN, ILO, PNUE, Global Compact, OECD and European Union standards. These are grouped in 6 domains of analysis and segmented into 41 sector sub-frameworks selecting and weighting the most relevant objectives. |

|

ISS |

1st to 10th decile, in each of four pillars – board structure, compensation and remuneration, shareholder rights, and audit and risk oversight. |

Based on 200 indicators divided into the four pillars. Weighs pillars accordingly, depending on regional governance standards. |

|

S&P Global Ratings |

Out of 100, compared against others in the same sector. |

Based on a questionnaire on 100 ESG issues, covering areas including operational eco-efficiency, privacy protection, risk and crisis management. |

|

Bloomberg ESG Data Service |

Out of 100, as well as a comparison with other agencies and analysis of a company’s historical ESG performance, plus comparison with the market. |

Using public information disclosed in corporate social responsibility (CSR) reports, websites and more. Checks and standardises data on 120 ESG topics. |

|

Thomson Reuters ESG Research Data |

Percentage and letter grade from A+ to D-. |

Analyses 400 metrics before selecting the 178 most relevant indicators. Also reports on 23 controversy topics, including tax fraud, human rights and consumer controversies. |

|

FTSE Russell |

0-5, with 5 being the highest. |

The FTSE Russell rating is spread on three layers, covering 300+ indicators and 14 ESG themes in three pillars — Environment, Social and Governance. |

|

RepRisk |

AAA to D. |

Using 80,000 different sources and focusing on 28 indicators that relate to the Ten Principles of the UN Global Compact. Also includes 45 topics such as gambling, fracking, and migrant labour. |

What is a Good ESG Score?

Answering the question: “What is our ESG score?” allows business leaders to begin asking more questions such as “What are the material ESG risks to our business? What are we doing to mitigate them?”

There are different rating scales available, covering varying factors, which may create a bit of a challenge in deciding what exactly constitutes a good ESG score. Fortunately, most scales will give you a general rating category such as “weak”, “average”, or “advanced”. This simplifies the use of an ESG score for sustainability initiatives because it gives you a starting point and a clear idea of whether you’re doing well or not.

It’s important to remember that sustainability is a journey, not a destination. Once your organisation has received its first ESG rating, it needs to constantly put in the effort to clarify its ESG strategy, set relevant goals, and improve reporting and governance. It may be a substantial investment of time and resources but one with a matching return. The growing number of ESG investors are extremely interested in companies that are constantly improving their ESG impact. So, the results are almost certain to come for your organisation.

For more information, see Euronext's ESG guidelines for listed companies.

|

Supporting Your ESG Transition As an issuer, you will face unique challenges in building and strengthening your Environment, Sustainability and Governance pillars. Our ESG Advisory service helps you address them quickly, making sense of investors’ expectations and crafting a comprehensive bespoke ESG strategy. Based on extensive data collection and analytics, this strategy enables you to attract new investors and improve the market perception of your organisation. |

The Future of ESG Ratings

The current system for ESG ratings looks like it will soon be subject to further standardisation. For example, the European Union is introducing a new classification system by 2022. Experts will draft up a taxonomy that will provide a “shared understanding of what sustainable means”. This will enable businesses to easily identify what economic activities can be considered environmentally sustainable and, as a result, to improve their ESG score.

In addition, laws and regulations are increasing the pressure on companies to be more transparent about all initiatives related to sustainability. One example is the European Directive 2014/95/UE dated 22 October 2014 which obliges public-interest entities with more than 500 employees to publish non-financial information, including information on environmental, social and employee matters, diversity, respect for human rights and on anti-corruption and bribery matters.

ConclusionKnowing your ESG rating has many advantages. It can show you how you rank within your sector for sustainability indicators as well as to work out where you can improve on your social impact, company management and more. Being able to prepare for challenges such as climate change as a result of knowing your ESG risks allows you to stay one step ahead of your competition. It might also alert you to issues that are difficult to identify such as the need to work hard on inclusion and diversity in the workplace and create an environment where all staff feel valued. Finally, the fact that a high ESG score also makes the business subject to more investor demand is another reason to prioritise improving this metric. |

References and Further Reading

Related articles

-

ESG Fund Names: What ESMA’s New Guidelines Mean For Issuers

Read the article -

New Governance solutions with AGM Voting Insight and ESG Data distribution

Read the article -

CSRD Reporting Requirements: A Comprehensive Guide

Read the article

Share this post